Car Insurance Fraud: All you need to know about Auto Insurance Fraud

Reading Time: 7 mins

The insurance industry is a collection of more than 7,000 individual companies that receive more than $1 trillion in premiums per year. With so much money going into the industry, it is a prime target for a wide variety of fraudulent activities.

The number of fraudulent incidents in Singapore has increased. Car insurance fraud has been steadily taking root and rising in Singapore over the years.

The Singapore Police Force (SPF) Commercial Affairs Department (CAD) reports that the recorded number of such incidents doubled from 13 in 2016 to 26 in September 2017.

This article will guide you about car insurance fraud. You will know how to spot insurance fraud, and how insurance companies in Singapore spot fraudulent activities.

What is insurance fraud?

If anyone provides wrong information to an insurance provider to obtain anything of value that they would not have earned if the truth had been told, they committed insurance fraud.

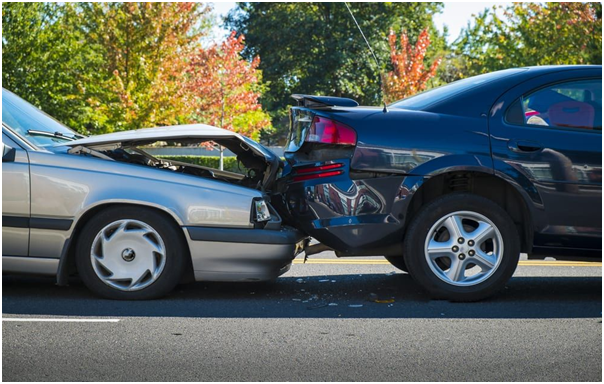

Car insurance fraud varies from misleading details about insurance claims to inflating insurance claims to staging incidents to filing claims for injuries or losses that have never occurred to false reports of stolen cars.

The most frequent insurance fraud cases in Singapore are auto, travel, and personal injury. Motor insurance fraud involves conspiring to make fraudulent or inflated statements concerning property damage or personal injury following an accident.

Cost of car insurance claims fraud in Singapore

In January 2017, the insurance industry adopted the Fraud Management Scheme, which aims to improve fraud detection and reduce the drastic loss of income arising from this all too prevalent phenomenon.

In the vehicle insurance policy category, the Executive Director of GIA (General Insurance Association of Singapore), Derek Teo, and its own Motor Convenor Sam Tan stated in a joint announcement that studies reveal that around 20% of claims have been manufactured or inflated.

In 2014, 19 people were charged with car insurance fraud for fraudulent actions committed in 2008-2009; the most serious defendant was fined $270,000 in staging incidents. In 2015, a 37-year-old man was charged with making car insurance claims of $465,000 by setting up a network of people who made fake accident statements. In 2016, a member of a well-organized union was jailed for 6 years for trying to cheat insurers of $1.1 million, of which $216,000 had already been paid out.

Common types of insurance fraud

There are three primary forms of insurance fraud:

Organized fraud

Fraudsters work together to plan accidents and then file inflated injury or loss claims to several insurers to avoid detection. This form of fraud is best dealt with by insurance agencies working in conjunction with law enforcement and the government.

Pre-meditated fraud

An individual makes a false insurance claim for issues like car damage that was not caused by an accident or medical attention that was not given. Sometimes fraud also includes a workshop or a recovery service provider.

Opportunist fraud

An individual inflates a legal claim, such as an overstatement of damages, a claim for damages that occurred before the accident, or a claim for property that was not actually stolen.

How to spot car insurance fraud?

In Singapore, not all accidents that happen are real; in fact, some are staged. How will you spot a staged accident? Here's what you're supposed to look for.

People involved

This involves – but is not limited to – the driver, the passenger, and the eyewitness. Generally, when an accident is staged, there will be several people on the scene who are working together to make it happen. For example, the first two cars in a chain collision might work together to scam other victims. Another example would be eyewitnesses turning up conveniently to back up the fraud.

Peer Pressure

Sometimes you just get into unavoidable incidents, and the third party is just as innocent as you are. Scammers will approach you and force you to go to a medical clinic or take your vehicle to a particular workshop.

Scammers might persuade you to go to those locations as they get a referral fee for any person they send there. These false workshops and clinics could overcharge you, not only for the referral but also for their own benefit. They might argue that your car is more damaged than you thought, claiming that more parts need to be repaired, increasing your bill.

Over-inflated medical claims

Whiplash and phantom pain are extremely difficult to detect on X-rays, so scammers can work with and pay off fraudulent clinicians, chiropractors, and physical therapists to validate their injury claims so that insurance firms can pay for them.

Helpers

"Jump-ins" are people who unexpectedly appear and jump into other vehicles, pretending to be passengers. You should also be cautious if other drivers and passengers complain that they are injured, despite minor damage to cars.

Tips to keep you safe from car insurance fraud

- Take care when dealing with insurance agents who travel from door to door selling policies. Confirm their legibility to the insurance provider.

- Be cautious of policies that are much cheaper than market prices. These policies may not offer you adequate coverage and are packed with exemptions that you find only when you need coverage.

- To check the legibility of the company and the agent, contact General Insurance Association of Singapore. They need to be approved.

- Install Dashcam to record the accident footage, which will benefit you immensely when you make insurance claims. Presenting video proof to the insurer will help them decide which party is really at fault, which will lead them to understand the case of fraud.

- Be careful of the cars that move in front of you, causing you to follow in a dangerously close range. You may be in for a staged accident.

- Carry your emergency kit (Properly inflated spare tyres, wheel wrench and tripod jack, jumper cables, tool kit and/or multipurpose utility tool, flashlight and extra batteries) at all times.

After an accident

- Obtain contact information such as driving license number, evidence of insurance, and vehicle registration with the person driving the car. Record the damage to both cars.

- Count the people in the car and ask them for their names, phone numbers, and addresses.

- Get in contact with the police and inform them of what happened.

- Keep people away from the scene who try to persuade you to visit a variety of lawyers or doctors.

- Don't fall for people who are offering you cash to repair your car.

- Ask for detailed bills for any emergency or repair care after an accident. Keep all of your receipts, too.

- Stop doctors who urge you to file a personal injury lawsuit even though you are not injured.

- Don't sign a blank insurance claim document.

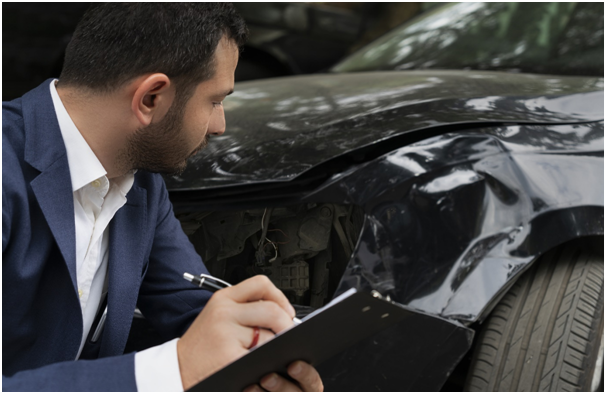

How insurance companies spot fraudulent activities?

Insurance providers cross-check individual claims whether or not they come from a valid source. If the same person receives multiple checks, this is a warning sign. Thousands of insurance providers, self-insured firms, and third-party administrators report all their claims to GIA Anti-fraud committee, an anti-fraud information system.

Some insurance agents are now using social media to search for fraudulent claims. Perhaps the claimant who claimed his car sustained hail damage will brag about his fraud on Facebook or Twitter, or will post a YouTube video showing how to make fake hail dents in your car hood.

Many insurers have Special Investigative Teams. Employees working in these teams usually have backgrounds such as detectives, police officers, medical staff, etc. They're capable of running an impressive number of tests and checks to bust someone attempting to commit fraud.

Insurance companies are also trying to distinguish some trends in your past claims about their frequency and type. You may not know that, but insurers maintain in-depth records of claims and conduct all kinds of assessments to evaluate the data they contain — from finding out who is most likely to file claims to when and where. If your argument doesn't follow the usual template, they'll note it.

Third-party reports can be of resourceful support when it comes to the disclosure of fraudulent insurance claims. Such reporters make confidential calls to warn insurance firms of any suspicious behavior. In return, they are given legal protection from some kind of retaliation.

Conclusion

Detection and avoidance of insurance fraud is a primary concern for insurers. Insurance fraud is not a crime without victims. This is expressed in the severe consequences for those found guilty of fraud, including custodial sentences.

The insurance industry continues to improve its processes and controls to ensure that all forms of fraud are identified and prevented — whether committed at the stage of the application or claim.

Need a car insurance or motorcycle insurance? Buy it from one of Singapore’s most trusted insurers – Direct Asia. Our insurance policy comes with reliability, transparency, value addition and hassle-free buying or claim process.

We are recognised for our impact in the industry. Singaporeans love our great prices, personal service and easy claims. The industry is taking note and recognizing what we're doing to change insurance in Asia.