Motor Insurance Fraud | What to Do to Avoid

Beware of False Insurance Claim Agents After a Car Accident!

Reading time: 4 mins

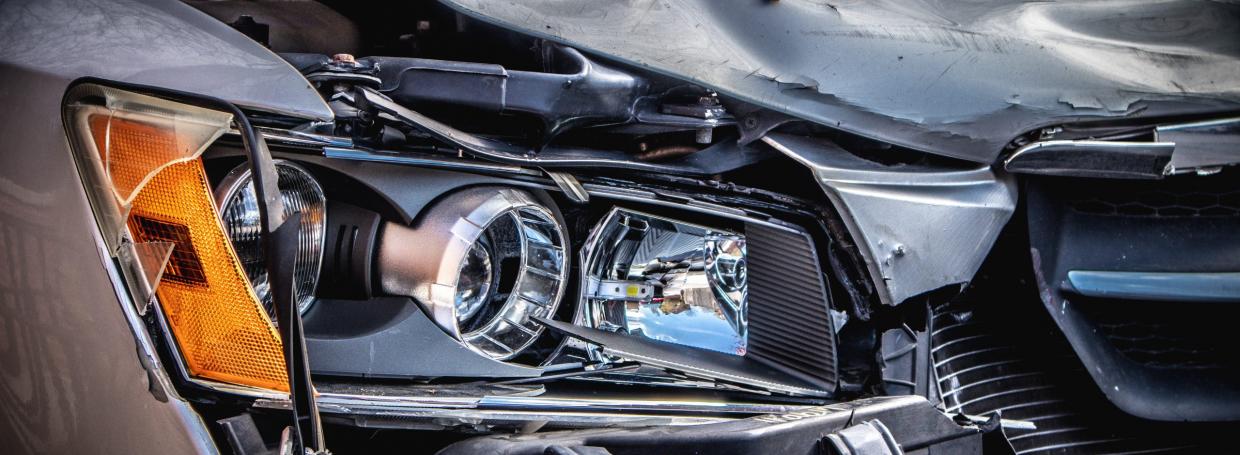

Imagine waking up in a rush one morning. You’re almost late for work but luckily traffic on the PIE is moving along at a good pace. Suddenly, without warning, you hear a loud crash and feel your car pushed forward by the vehicle behind.

You slowly recover from the shock and realise that the vehicle behind you has squashed your car’s rear bumper. You try to wrap your head around this very unlucky turn of events, and then you hear a loud knock on your car door window.

A strange man is standing outside your car. He claims to be an insurance specialist and offers to bring your car to an automotive workshop nearby which can help to settle your repairs and insurance claims.

What do you do? At this point, you might have some possible questions surface in your head. This article highlights some of them: ; Who are these false agents? How do they operate? Read on to understand what goes on that most drivers may not be aware of..

Who are these false insurance claim agents?

You should know that scenarios like this are happening more frequently in Singapore. In fact, you probably would have read many articles about false insurance claim specialists touting car owners at the scene of the accident in the news or on social media.

The most recent case reported was in February 2020, when a motor insurance fraud mastermind got convicted for a series of offences relating to car insurance fraud. He was sentenced to 51 months’ imprisonment after being found guilty of engaging in a conspiracy to cheat, give false information to a public servant, and reckless driving.

So, who are these ‘false agents’ and how do they get to the scene of the accident so quickly?

Well, it’s no surprise that these ‘insurance claims specialists’ are not actually from car insurance companies. Some refer to them as ‘floaters’ and predict that there are hundreds of them on the road at any given time scanning for accidents.

What do false insurance claim agents offer?

Fraudulent car insurance agents basically conspire in making false claims involving property damage as a result of an accident. They also specialise in grossly exaggerating personal injuries suffered by the accident victims.

There have even been cases where accident claims were lodged by phantom passengers claiming to have suffered grievous injuries. Some go as far as staging accidents in order to make fraudulent insurance claims or fake injury claims after convincing drivers that this will help them claim extra money for their own damages.

Be careful not to fall for these false agents promising monetary rewards by participating in such fraudulent car accident claims.

How do false insurance claim agents operate?

Basically, once a floater spots a car accident — or hears of one via intel from his many scouts along the expressway — he immediately approaches the driver to offer his array of services. If it’s an accident involving multiple cars, the floater will typically head towards the first vehicle as it’s easier to pin the fault on the vehicle behind.

Taking advantage of the shock and panic any driver would experience after an accident. These fraudsters come with a sense of calm, claiming to know what to do and who to trust. They will recommend a trusted workshop and offer to take care of all the paperwork including a replacement car that entices many drivers. The false agent then offers to help with the insurance claim. All these in a bid to present an easy, fuss-free, and ultimately attractive option for the car owner.

It is also not surprising that these fraudsters sometimes show up with the same vehicle as the accident victim. It’s like a play of psychology. Drivers tend to be more willing to trust other drivers that own the same type of car.

How do false insurance claim agents and the workshop they represent profit?

You’re probably wondering why someone would go through all the trouble to put in a false car insurance claim. Well, it could be very lucrative for both the false agents and the workshops they recommend.

For example, a workshop might submit an invoice for a brand-new bumper (to replace a damaged bumper) appearing as though it was bought directly from the car manufacturer. Because buying car parts directly from the car manufacturer is often more expensive. However, instead of replacing the damaged bumper with a direct spare part, the workshop might repair it themselves or procure a cheaper bumper from a local supplier.

At the end of the day, the workshop only incur a small fee for replacing or repairing the broken bumper, but claims a substantial amount from the insurance company. This then allows the workshop to give a good pay out to the false insurance claim agents as a commission.

What to do if a false insurance claim agent touts you?

Firstly, you should be aware of what to do in a car accident. No matter if it was caused by another driver or if you are at-fault, there are two important things to do. One, gather detailed evidence of the accident scene. Two, contact the car insurance provider you’re registered with (within 24 hours) to ensure a smooth claims process.

Check your car insurance policy and cover type so you know what damages can be claimed. And when you speak to your insurance company’s insurance claims specialist, check which authorised workshop you can send your car to for repairs.

If there are false agents touting you at the scene of the accident, the best thing to do is to ignore them while gathering all the information required from the other driver. Then, get back into your car, and lock your doors before contacting your insurer.

Do not offer these false agents your personal details or any information about your insurance policy. This is why it’s important to know what to do after an accident. Check all details with your insurer to prepare for such situations if it ever happens.

Don’t Risk Losing Your Car Insurance Claim

Keep in mind that if you falsify any details of your insurance claim, your claims request can be rejected altogether. Avoid making any mistakes in your car insurance claim and understand your car insurance policy well.

Finally, seek clarification of any details you are unsure of with your actual insurance claims specialist to protect your insurance claim.